So, you’ve finally decided to invest your money — great move! But the moment you start… BOOM 💥 — you’re hit with two big options: Stocks or Mutual Funds.

Confused about which one to choose? You’re not alone.

In this guide, we’ll break down stocks vs mutual funds in the most simple, no-jargon way — so you can start investing confidently and smartly.

🧠 First Things First: Why Even Invest?

If you leave your money in a savings account, it earns 2–4% interest (and inflation eats most of that).

Investing lets your money grow over time — so you can build wealth, beat inflation, and reach goals like travel, buying a house, or early retirement.

🏦 What Are Stocks?

When you buy a stock, you’re buying a small piece of a company — like TCS, Apple, or Reliance.

- If the company does well → stock price goes up → you profit

- If it fails → stock price drops → you lose money

✅ Pros:

- Higher returns possible

- You have full control

- Learn more about the market

❌ Cons:

- High risk (prices fluctuate daily)

- Requires time, research, and knowledge

- One bad stock = your money can tank

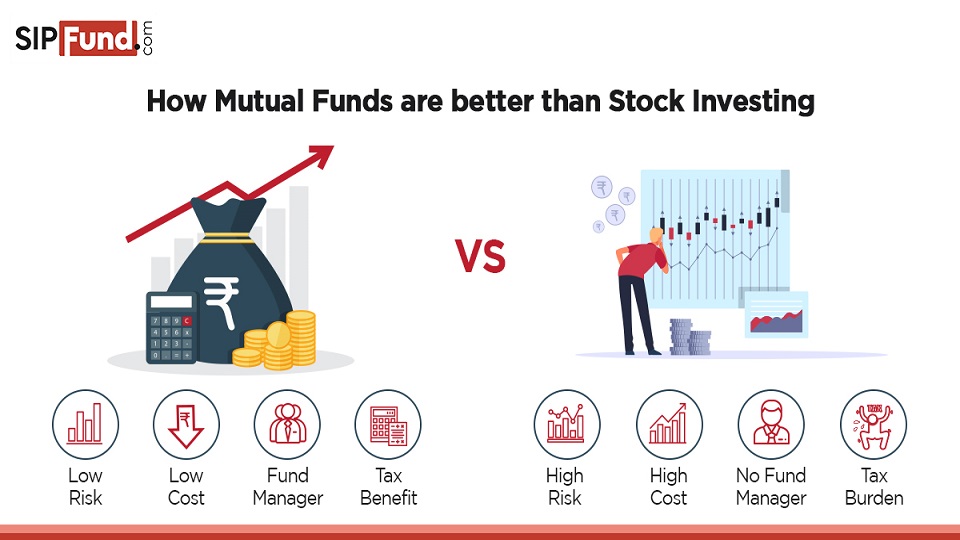

🤝 What Are Mutual Funds?

A mutual fund pools money from many investors and is managed by an expert (fund manager).

They invest that money into a mix of:

- Stocks

- Bonds

- Gold

- Other assets

You get diversified exposure with just one fund.

✅ Pros:

- Beginner-friendly

- Lower risk (diversified portfolio)

- Professionally managed

- Start with as little as ₹100 (via SIP)

❌ Cons:

- Returns are slower than direct stocks

- You pay small fees (called “expense ratio”)

- Less control over exact investments

📊 Quick Comparison Table

| Feature | Stocks | Mutual Funds |

|---|---|---|

| Risk | High | Medium to Low (depends on fund) |

| Returns Potential | Very High (and very low too) | Moderate and stable |

| Control | Full (you pick) | None (fund manager decides) |

| Ideal For | Active learners, risk-takers | Beginners, busy people |

| Start Amount | ₹100 – ₹500 | ₹100 (SIP) |

| Time Needed | High (research required) | Low (set and forget) |

| Tax Benefits | Depends | ELSS Mutual Funds give benefits |

🧪 Real Life Example:

Let’s say you have ₹5,000 to invest.

Option 1: Stocks

You buy shares of Tata Motors. If the stock goes up 10%, you make ₹500.

But if it drops 10%, you lose ₹500. High risk, high reward.

Option 2: Mutual Fund (SIP)

You invest ₹1,000 every month in a good Equity Mutual Fund. It grows steadily over years. Less risk, more consistency.

🧠 Which One Should You Choose?

✔️ Go with Stocks if:

- You enjoy reading about companies, markets, trends

- You can spend time tracking your portfolio

- You’re okay with short-term ups and downs

✔️ Go with Mutual Funds if:

- You’re just starting out

- You want less risk and more stability

- You don’t have time to research stocks

- You prefer “set it and forget it” investing

🛠️ How to Get Started (Step-by-Step)

For Stocks:

- Open a Demat account (Zerodha, Groww, Upstox, etc.)

- Add funds

- Start small — research good companies

- Invest and track regularly

For Mutual Funds:

- Download Groww, Zerodha Coin, Paytm Money, etc.

- Pick a good SIP in a fund like:

- Axis Bluechip Fund

- HDFC Flexi Cap

- Mirae Asset Emerging Bluechip

- Set auto-debit every month

- Let it grow passively

💡 Final Advice

- Don’t rush. Start small and learn as you go.

- Avoid “hot tips” or following hype blindly

- Invest consistently — not just when markets are rising

- Reinvest your returns for compounding magic

“The best time to invest was yesterday. The next best time is today.” 🚀

Need help choosing your first SIP or stock? Just say “guide me bro” and I’ll give you personalized beginner picks. 💸📲